Jerome Powell Hints at Rate Cut in July: What Does It Mean for Bitcoin and Your Crypto Investments?

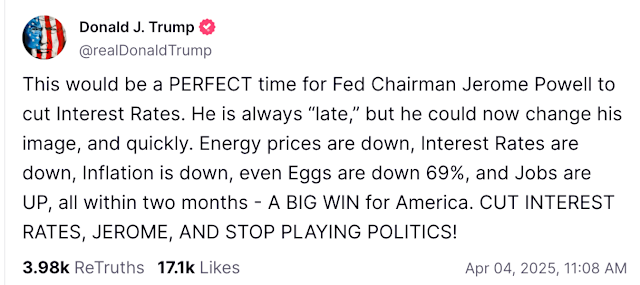

In a surprising turn of events, Federal Reserve Chairman Jerome Powell recently hinted that interest rate cuts could materialize as early as July 2025, sparking widespread speculation across financial markets. This statement, comes amid close monitoring of inflation and the impact of new tariffs on Canada, Mexico, and China—estimated by the Boston Fed to potentially raise inflation by 0.5-0.8%. For crypto enthusiasts and investors, this raises a critical question: What does a rate cut mean for Bitcoin price, crypto market trends, and your broader crypto investment portfolio? Let’s break it down step by step, starting with the basics of what a rate cut entails, its effects on Bitcoin, cryptocurrency prices, and other financial assets, and what might happen if a significant 1% rate cut—such as one urged by former President Donald Trump—comes to fruition.

What Is a Rate Cut, Anyway?

A rate cut refers to the Federal Reserve’s decision to lower the federal funds target rate, the interest rate at which banks lend to each other overnight to meet reserve requirements. This is a key tool of monetary policy aimed at stimulating economic activity. When the Fed cuts rates, borrowing becomes cheaper for businesses and consumers, encouraging spending and investment. Conversely, it reduces the returns on savings accounts and bonds, pushing investors toward riskier assets like Bitcoin and cryptocurrencies.

The Fed adjusts rates based on economic indicators like inflation, employment, and growth. For instance, after aggressive rate hikes in 2022 to curb inflation (which a Federal Reserve study showed reduced it by 0.5% annually), the current focus on tariffs and potential economic slowdown has shifted the narrative toward easing. A July rate cut would signal the Fed’s intent to support the economy, with significant implications for crypto trading and investment strategies. Learn more about how the Fed influences markets at Federal Reserve Education.

How Does a Rate Cut Affect Bitcoin and Crypto?

Cryptocurrencies, particularly Bitcoin, are highly sensitive to changes in monetary policy due to their decentralized nature and role as alternative stores of value. Here’s how a rate cut could impact Bitcoin price and crypto market trends:

- Increased Liquidity and Risk Appetite: Lower interest rates flood the market with cheaper money. As noted in a recent Forbes article (September 2024), this often drives investors toward risk assets like stocks and cryptocurrencies, especially when traditional investments like bonds offer lower yields. Bitcoin, often dubbed “digital gold,” could see a price surge as investors seek higher returns.

- Weaker Dollar Effect: Rate cuts typically weaken the U.S. dollar, making dollar-denominated assets like Bitcoin more attractive to international investors. Historical data from the 2024 50 bps cut showed Bitcoin rallying 15% in the following week, per CoinLedger (2025).

- Short-Term Volatility: However, the transition isn’t always smooth. The same Forbes report highlighted that aggressive rate cuts can trigger short-term volatility, with Bitcoin prices swinging as markets digest the news. A recent 6.24% drop in crypto market cap (Coinbase, April 2025) suggests current caution, which a rate cut could either alleviate or exacerbate.

- Long-Term Hedge Potential: A ScienceDirect study (2025) on monetary policy and Bitcoin notes its evolving role as a hedge against inflation and currency devaluation. If a rate cut signals economic weakness, Bitcoin might attract more capital as a safe haven, though its volatility remains a wildcard.

For the broader crypto market, altcoins like Ethereum or smaller tokens could follow Bitcoin’s lead, though gains might be uneven. High-debt or speculative projects might see less traction if investors prioritize established assets. Check out the latest crypto market trends at CoinMarketCap.

Ripple Effects on Other Financial Markets

A rate cut doesn’t just impact crypto investments—it reshapes the entire financial landscape:

- Stocks: Lower rates typically boost stock prices, especially in growth sectors like technology, as borrowing costs decline. However, a 5paisa article (February 2025) warns of potential corrections if rates fall too quickly, affecting high-debt companies.

- Bonds: Bond yields drop as rates decrease, making them less appealing. This could push institutional money into equities or crypto, per Bankrate (June 2025).

- Real Estate: Cheaper mortgages stimulate housing demand, but excessive easing could inflate property bubbles, a concern raised by Bolton (2025).

- Commodities: Gold and oil prices often rise with a weaker dollar, though their 2022 spikes post-rate hikes were short-lived (Bankrate, 2025).

What If Trump Gets His Wish: A 1% Rate Cut?

The whole world knows how Trump has been pro crypto since his campaign days, and he has brought in maximum favourable crypto regulations to help crypto market and investors including Bitcoin Strategic reserve, Stablecoin bill and many other things. He has also at many occasions publicly urged the Fed to implement a substantial rate cut, with some analysts speculating a 1% (100 bps) reduction could be on the table if economic pressures mount.

Such a move would be unprecedented in the current context and could have dramatic effects on Bitcoin price and crypto investments:

- Massive Liquidity Boost: A 1% cut would inject significant liquidity into the economy, potentially driving Bitcoin prices up by 20-30% in the short term, based on the 2024 50 bps cut’s 15% rally (CoinLedger, 2025). The broader crypto market could see a 15-25% surge, though altcoins might lag if risk appetite focuses on Bitcoin.

- Inflation Concerns: A sharp cut could raise fears of uncontrolled inflation, especially with tariff-related price pressures (Boston Fed, 2025). This might position Bitcoin as a hedge, but a ScienceDirect study suggests its correlation with traditional markets could lead to a mixed outcome if stocks falter.

- Volatility Spike: A 1% cut would likely trigger extreme volatility, with Bitcoin prices possibly dropping 10-15% initially before recovering, as seen in the 2019 rate cut’s 30% dip (moomoo Community, 2025). Investors should brace for wild swings.

- Global Impact: A bold move could weaken the dollar significantly, boosting crypto trading globally but risking capital flight if other central banks respond aggressively. Explore global crypto market trends at CoinGecko.

What Should Crypto Investors Do?

If a rate cut looms in July, consider these steps:

- Diversify: Balance your crypto investment with stablecoins or traditional assets to mitigate volatility, as suggested by CoinLedger (2025).

- Monitor Fed Signals: Watch the next FOMC meeting (mid-July 2025) for clarity on the cut’s size.

- Use Tools: Leverage platforms like Coinbase for real-time data and stop-loss orders to manage risks.

In conclusion, Jerome Powell’s hint at a July 2025 rate cut could be a game-changer for Bitcoin price, crypto market trends, and your crypto investments. A standard cut might lift prices 5-20%, while a Trump-backed 1% reduction could spark a 20-30% rally—or a volatile correction. Stay informed with the latest monetary policy updates at Investopedia and adjust your crypto trading strategy accordingly.

What are your thoughts on this potential shift? Share in the comments below!