Aptos: The Silent Contender That Might Redefine Web3

In a world where blockchain technology is reshaping how we trade, create, and connect online, many promising networks struggle to deliver on their potential. High transaction fees, frequent outages, and slow processing speeds have slowed the path to mainstream adoption. Launched on October 17, 2022, as Aptos Autumn, Aptos is a Layer 1 blockchain that tackles these challenges with a design built for scalability, security, and reliability. Crafted by over 350 developers, including former Meta Diem engineers, Aptos uses the Move programming language, a unique parallel execution system, and a robust consensus mechanism to power decentralized applications (dApps). With no major outages, a peak performance of 19,200 transactions per second (TPS), and a thriving ecosystem Aptos is quietly positioning itself as a cornerstone of Web3. This article dives into how Aptos overcomes blockchain barriers and why it’s a force to watch.

Overcoming Blockchain’s Biggest Hurdles

Blockchains have sparked a wave of innovation, enabling thousands of dApps for decentralized finance (DeFi), NFT marketplaces, gaming, and social platforms. Yet, widespread adoption remains out of reach due to critical limitations. Ethereum’s network congestion can drive gas fees into hundreds of dollars, making simple transactions unaffordable for many users. Solana, despite its speed, has faced multiple outages, shaking trust in its reliability. These issues stem from the blockchain trilemma the challenge of balancing security, scalability, and decentralization. Aptos addresses this with a permissionless, community driven network, allowing anyone to build without approval. Governed by its global community of developers and users, Aptos delivers a trusted, cost-efficient platform similar to cloud infrastructure. In a 2024 stress test, it processed 326 million transactions at 37 TPS without fee spikes or downtime, showcasing its ability to handle real-world demands. With a theoretical capacity of 160,000 TPS, real-world averages of 2,200 TPS, and peaks at 19,200 TPS, Aptos is engineered to scale seamlessly.

A Visionary Team and Community Governance

Founded in 2021 by Mo Shaikh and Avery Ching , both former Meta Diem engineers, Aptos Labs is based in Palo Alto and backed by $400 million from investors like Andreessen Horowitz, Binance Labs, and Franklin Templeton. The team, including contributors like Alden Hu, Alin Tomescu, David Wolinsky, and Greg Nazario, leveraged their Diem experience to build a scalable blockchain. Partnerships with Microsoft, Google Cloud, and NBCUniversal amplify Aptos’ reach. The network is governed by 500 nodes, including 145 validators, and community-driven Aptos Improvement Proposals (AIPs), ensuring decentralization. Initiatives like Free Transaction Week (through July 30, 2025) and the Vietnam Aptos Hackathon foster engagement, while the Aptos Foundation’s 5 million APT grant program has awarded over 200 grants to support developer tools, DeFi, and NFT projects, driving ecosystem growth.

Aptos Architecture: Built for Speed and Security

Aptos is a permissionless Layer 1 blockchain tailored for modern Web3 applications, from DeFi and NFTs to gaming and social media. Its modular, pipelined architecture optimizes transaction processing by running dissemination, metadata ordering, execution, storage, and certification simultaneously, maximizing hardware efficiency. Unlike traditional blockchains that process transactions one at a time, Aptos uses 16 CPU cores to achieve sub-second finality (600 milliseconds) and a peak of 19,200 TPS. The Move programming language, developed for Diem, ensures secure dApp development by preventing asset duplication or deletion. The Move Prover, a formal verification tool, mathematically checks smart contract correctness, reducing vulnerabilities for high-stakes applications like DeFi or RWAs. Aptos’ data model supports flexible key management, hybrid custodial options, and transaction transparency before signing, enhancing user safety.

The AptosBFT consensus, an optimized version of the HotStuff protocol with Proof-of-Stake (PoS), ensures security by tolerating up to one-third of validators being malicious or offline. The BullShark algorithm and active pacemaker synchronize validators in just two network round trips, while a redundancy system prevents outages by allowing nearby nodes to replace failed leaders, unlike Solana’s less reliable design. The Quorum Store mempool separates transaction dissemination from ordering, enabling validators to stream batches in parallel, boosting throughput (50x raw consensus, 10x end-to-end) as more validators join. Storage uses a Jellyfish Merkle Tree (JMT) split across multiple RocksDB instances for parallel state updates, while ledger certification combines fast per-block state diff hashing with epoch-end snapshots for trustless verification.

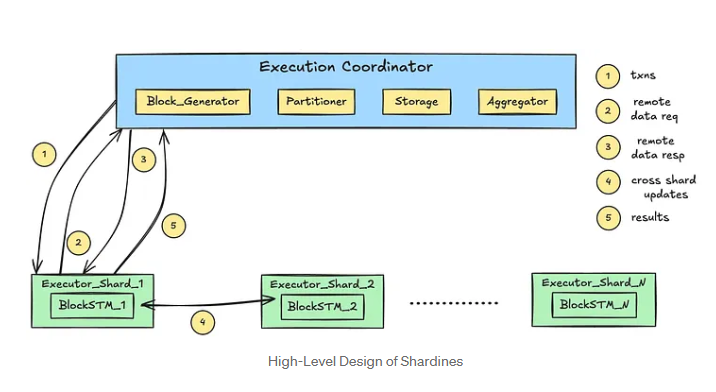

Recent upgrades push performance further. The Zaptos upgrade cuts latency by 40% at 20,000 TPS (0.78s vs. 1.32s) through optimistic execution, commits, and certification, achieving 130–150 ms block times. The upcoming Raptr consensus blends DAG and leader-based approaches for optimal latency, while Shardines scales execution to 1M TPS with 30 shards using hypergraph partitioning to minimize cross-shard dependencies. Aptos is also exploring internal and homogeneous state sharding to enable horizontal scalability without added complexity.

Key architectural strengths include:

-

Block-STM Parallel Execution: Processes complex transactions concurrently without requiring predefined data dependencies, using a multi-version data structure, collaborative scheduler, and dynamic dependency estimation. It delivers up to 17x higher performance than sequential execution, achieving 170,000 TPS in benchmarks and handling 326 million transactions in a day during a 2024 stress test for high-frequency applications like trading or gaming.

-

Move Language and Prover: Move’s intuitive, Rust-based syntax and linear logic prevent vulnerabilities like double-spending, reducing code size by 30–40% and audit costs. The Move Prover ensures contract reliability, while features like tables and fine-grained storage support large datasets, such as millions of NFTs, for DAOs or NFT minting.

The APT Token: Fueling Transactions and Governance

The APT token, with a market cap of $2.84 billion and a fully diluted valuation of $4.95 billion as of august 1, 2025, drives the Aptos ecosystem. With $671.17 million circulating tokens and a total supply of $1.17 billion, APT recorded a 24-hour trading volume of $537.27 million, up 69.50% in 24 hours. Traded on exchanges like Binance, Icrypex and MEXC (APT/USDT, $267.44 million daily volume). APT’s price is $4.24, down 78.67% from its all-time high of $19.92 but 37.97% above its low of $3.08. APT covers transaction fees averaging $0.000569, far cheaper than Ethereum’s high costs, making it accessible for users. Holders can stake APT to validate transactions, secure the network, and earn rewards, or delegate to trusted validators. Governance allows voting on AIPs to shape protocol development. The Aptos Foundation Grant Program, with a 5 million APT budget, supports ecosystem growth through 200+ grants for developer tools, DeFi, and NFT projects.

Aptos Ecosystem: A Thriving Web3 Community

Aptos supports over 190 projects across DeFi, GameFi, NFTs, and social media, driving $5.4 billion in monthly DEX volume, $1.4 billion in stablecoin liquidity, $530 million in RWAs, and $835,000 in app revenue. Its community, with 668.3K Twitter followers, 289,670 Discord members, and 119,879 Telegram users, fuels engagement. Wallets like Petra, Martian, Pontem, and Aptos Connect (with social login and support for Visa, Mastercard, Apple Pay, or Google Pay via MoonPay) simplify asset management. Block explorers like Aptos Explorer, Aptoscan, and Xangle Explorer ensure transparency. Stablecoins, including Tether’s USDT ($1 billion integrated), BlackRock’s BUIDL ($53.2 million), Ondo’s USDY ($16.1 million), and Thala’s MOD ($3.5 million), strengthen DeFi. The APRO RWA Oracle provides AI-powered price feeds and Proof of Reserve for the $530 million+ RWA ecosystem. Partnerships with Mastercard, Microsoft, Google Cloud, and LayerZero (supporting 70+ blockchains) enhance trust and interoperability.

Key ecosystem projects include:

-

DeFi Leaders: PancakeSwap offers low-fee swaps, Thala Labs supports $6 billion+ TVL via USDe, and Echelon Market enables lending and trading with $90 million+ in sUSDe, driving liquidity for financial applications.

-

Gaming and NFTs: Tapos, a play-to-earn game with virtual cats, set a record of 326 million transactions in a day. Chingari, a Web3 streaming platform, has 55 million downloads and 125,000 daily users. NFT projects like Aptos Monkeys, GUI Gang, and Rarible power digital art markets, with NBCUniversal’s Renfield tokenizing a Nicolas Cage film.

Simplifying Development and User Experience

Aptos makes Web3 accessible for developers and users. For developers, Move’s automatic safety checks and Block-STM’s parallel execution reduce code size and audit costs, enabling complex dApps like DEXs without performance trade-offs. The Move Prover verifies contract behavior, ensuring reliability for high-value applications. Tools like Aptos Build, SDKs (TypeScript, Python, Rust), and Aptos Explorer streamline development, while tutorials on Aptos Build and Shinami support coding Move modules. For users, Aptos Connect’s keyless wallet with social login simplifies onboarding, supporting payments via Visa or Google Pay. Transaction pre-execution simulates outcomes, protecting against attacks like the $1 billion Bybit exploit. Upcoming features like X Chain Accounts, multi-sig accounts, and scheduled transactions will enable seamless automation, mimicking Web2 simplicity with sub second finality and low fees.

Aptos vs. Other Blockchains: A Competitive Edge

Aptos stands out among Layer 1 competitors. Compared to Solana, Aptos’ 160,000 TPS (19,200 peak) surpasses Solana’s 65,000 TPS (4,000 average), with a redundancy system avoiding Solana’s outages, though requiring higher hardware. Against Sui, Aptos’ account-based model and 13,367 TPS outperform Sui’s object-centric DAG and 634 TPS, supporting broader use cases (DeFi, GameFi, NFTs, AI, social). Versus Ethereum, Aptos’ 600 ms finality and $0.000569 fees contrast with Ethereum’s 1-minute finality and higher costs, though Ethereum’s established security remains a benchmark.

Getting Started with Aptos

Joining Aptos is straightforward for users and developers. Set up a wallet like Petra or Aptos Connect to manage APT, purchasable on Binance, MEXC, or LBank. Developers can code Move modules using the Aptos CLI, SDKs, and Testnet Faucet, with tutorials on Aptos Build or Shinami. Explore the network via Aptos Explorer or apply for grants through the Aptos Foundation Grant Program to fund innovative projects.

Why Aptos Is a Game-Changer

With 19,200 TPS, 600 ms finality, and $0.000569 transaction fees, Aptos delivers a scalable, secure, and upgradeable platform for Web3. Its $5.4 billion DEX volume, $1.4 billion stablecoin market, and $530 million in RWAs power a thriving ecosystem of 190+ projects. Backed by partnerships with Microsoft, Mastercard, and Google Cloud, and a focus on developer and user experience, Aptos is quietly building the infrastructure to redefine decentralized finance, gaming, NFTs, and beyond, making it a blockchain to watch.