Celestia: The Modular Blockchain That’s Changing the Game

Imagine a world where starting your own blockchain is as simple as posting a meme. Where sending transactions is faster than a trending TikTok video. And where scaling is not a problem, but a smart and easy solution. Sounds like a sci fi movie, right? But it’s real. Welcome to Celestia the world’s first modular blockchain. It launched on October 31, 2023, and surprised everyone with a massive gift a free TIA token airdrop to over 5.8 lakh users! But Celestia is not just another crypto project. It’s here to change how blockchains are built and used making them faster, simpler, and more flexible than ever before. Get ready to explore a whole new world of ideas and possibilities. By the end, you’ll understand why Celestia’s modular technology is such a big deal and why many believe it’s the future of blockchain.

A New Way to Build Blockchains: Celestia’s Modular Magic

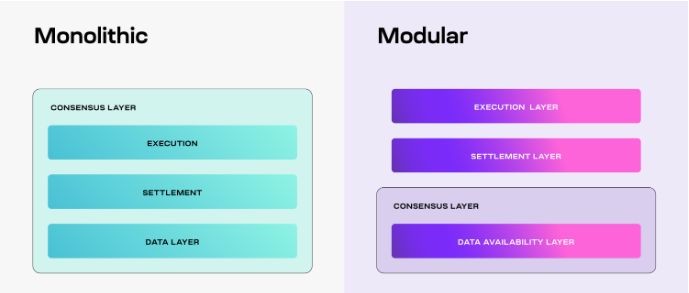

Most blockchains today try to do everything by themselves, like a single chef who is cooking, serving, and washing dishes all at once. It becomes messy, tiring, and slow. Celestia does things differently, Instead of doing everything, it focuses only on data availability. This means it makes sure all the transaction data is stored safely and is easy to access. Think of it like a Dropbox for blockchain data reliable, simple, and always available.

This smart design makes Celestia the first truly modular blockchain. It separates the main parts of a blockchain like data, consensus, and execution. So, developers don’t need to deal with complex rules or build everything from scratch. In simple words, Celestia gives developers a blank canvas to create their own blockchains in their own way, without limits.

The project started in 2019 under the name LazyLedger. It was founded by Mustafa Al Bassam, Ismail Khoffi, and John Adler. The idea came from new research on Data Availability Sampling and Namespaced Merkle Trees. These ideas were also explored with Ethereum co founder Vitalik Buterin. Today, Celestia is supported by the Celestia Foundation. The main team includes Mustafa, Ismail, Batuhan Dasgin, and Reinhold Wohlwend. Their goal is to make blockchain creation as easy as launching a mobile app. As of August 2, 2025, the TIA token is priced at $1.64, with a market cap of $1.2 billion. Celestia is now a rising star in the world of crypto.

The Suspenseful Mechanics: How Celestia Works

Let’s pull back the curtain on Celestia’s inner workings, where the plot thickens with cutting edge tech. Unlike monolithic blockchains that cram execution, settlement, consensus, and data availability into one layer, Celestia splits these tasks into specialized layers. It focuses on two key roles: ordering transactions and ensuring their data is available. It leaves smart contract processing and computations to other layers, like rollups or custom chains. This lean approach is like a sleek racecar built for speed, not a clunky van trying to do it all.

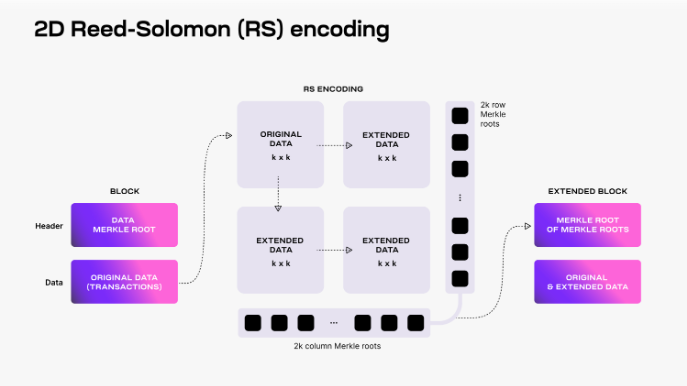

At the core of Celestia’s magic is Data Availability Sampling (DAS), a thrilling technique that ensures data is available without forcing users to download entire blocks. Light nodes nimble devices with basic computing power randomly sample small data pieces using a 2 dimensional Reed Solomon encoding scheme. Block data is split into shares, arranged in a matrix, and extended with parity data to prevent loss. Light nodes query full nodes for random shares and proofs, confirming the block’s availability with high confidence. The twist? The more light nodes join, the more data the network can handle, scaling seamlessly as participation grows.

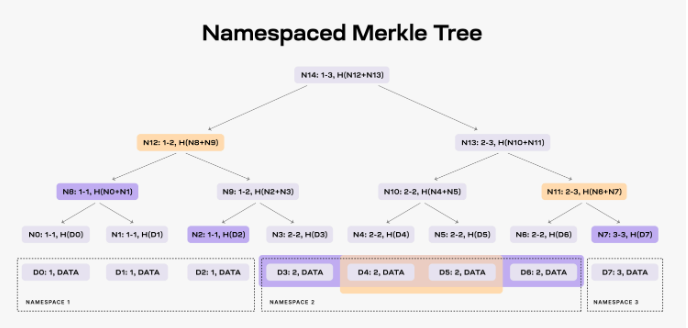

Adding to the suspense, Namespaced Merkle Trees (NMTs) keep data organized like a futuristic librarian. Each app or rollup gets its own “namespace,” allowing it to fetch only relevant transactions, ignoring the rest. NMTs provide proofs to ensure all data is delivered, boosting efficiency and trust. Running on a proof of stake (PoS) system, Celestia uses TIA tokens for staking, governance, and paying for blobspace the space where data is stored. It’s a decentralized masterpiece that’s secure and community driven.

Why Modular Blockchains? The Big Reveal

Why is Celestia’s modular approach such a big deal? Traditional blockchains are like all in one printers functional but slow and limited. By decoupling tasks, Celestia unlocks a treasure trove of benefits that make developers and users sit up and take notice:

-

Easy Deployment: Launching a blockchain is now as simple as setting up a website. Developers can create rollups specialized blockchains that process transactions and rely on Celestia for data availability without needing their own validators or tokens. It’s like renting a fully furnished apartment instead of building a house.

-

Scalability That Shocks: Celestia’s DAS allows the network to handle larger blocks as more light nodes join, perfect for high traffic apps like DeFi or gaming. It’s like a highway that adds lanes as more cars arrive.

-

Customizability for the Win: Developers can tweak their rollup’s virtual machine (VM) for specific needs, like parallel processing or private contracts, without being locked into a one size fits all system.

-

Congestion Isolation: Each rollup operates independently, so a busy app won’t slow down others, keeping the network smooth and efficient.

Inside Celestia: The Features That Set It Apart

Let’s zoom in on the features that make Celestia a blockbuster in the blockchain saga:

-

Data Availability Sampling (DAS):

-

Light Node Accessibility: DAS enables anyone with a basic internet connection to run a light node, democratizing blockchain participation. These nodes randomly sample small data shares from a 2 dimensional matrix, verifying block availability with minimal resources. This ensures even low powered devices can contribute to network security.

-

Scalability Powerhouse: As more light nodes join, Celestia can process larger blocks, increasing transaction throughput without compromising security. It’s like a crowd sourced effort where each participant checks a small piece, collectively ensuring the whole puzzle is complete.

-

Decentralized Security: The collective sampling by light nodes creates a robust safety net. Even if some nodes are offline, the network remains secure, with the probability of false positives (accepting invalid data) reduced to near zero through fine tuned parameters.

-

-

Namespaced Merkle Trees (NMTs):

-

App Specific Efficiency: NMTs tag data with namespace identifiers, allowing apps to fetch only their relevant transactions, saving time and resources. It’s like a personal assistant who hands you exactly the files you need, ignoring the rest.

-

Proof of Completeness: NMTs provide cryptographic proofs to ensure apps receive all their data, preventing any sneaky omissions. This is critical for trust in a permissionless network where anyone can participate.

-

Scalable Performance: By organizing data into namespaces, NMTs enable rollups to operate efficiently, even as the network grows, making Celestia ideal for large scale applications.

-

Celestia also supports sovereign rollups, which operate independently from the DA layer, giving developers full control to build app specific blockchains. Its Rollups as a Service model, with providers like AltLayer, Caldera, and Conduit, makes launching a rollup as easy as ordering takeout, turning blockchain creation into a breeze.

TIA: The Fuel Powering Celestia’s Rocket

The TIA token is the heartbeat of Celestia’s ecosystem, powering everything from data storage to governance. Developers use TIA to pay for blobspace through PayForBlobs transactions, ensuring their data is securely stored. Validators stake TIA to secure the network, and users can delegate tokens to earn rewards. Unlike some blockchains, holding TIA is enough to vote in governance no staking required.

With an initial supply of 1 billion tokens and an 8% annual inflation rate (decreasing over time), TIA is designed to grow with the network. As of August 2, 2025, TIA trades at $1.64, with a market cap of $1.2 billion and a fully diluted valuation of $1.87 billion. Its 24-hour trading volume of $141.09 million shows strong market buzz, making TIA a hot ticket on exchanges like Binance, Gate, and KuCoin.

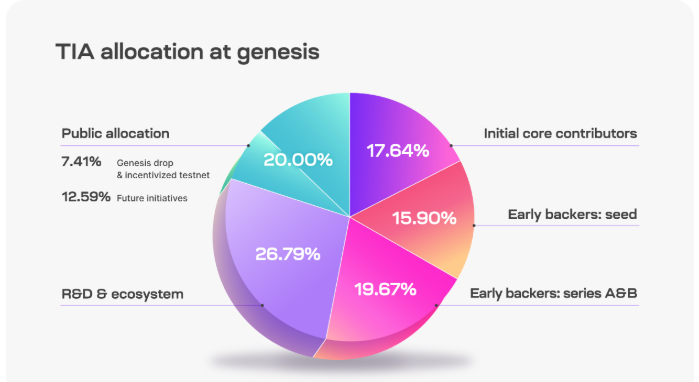

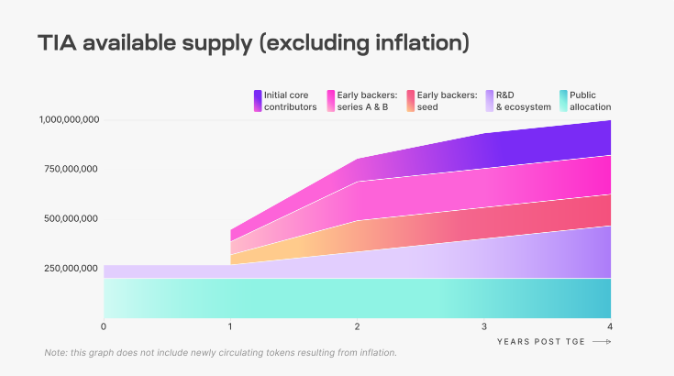

Celestia will have a total supply of 1,000,000,000 TIA at genesis, split across five categories described in the chart.

-

Public Allocation: Genesis Drop and Incentivized Testnet: 7.41%, Future initiatives: 12.59% (20.00%)

-

R&D & Ecosystem: Tokens allocated to the Celestia Foundation and core devs for research, development, and ecosystem initiatives including:

-

Protocol maintenance and development

-

Programs for rollup developers, infrastructure, and node operators (26.79%)

-

-

Early Backers: Series A&B: Early supporters of Celestia (19.67%)

-

Early Backers: Seed: Early supporters of Celestia (15.90%)

-

Initial Core Contributors: Members of Celestia Labs, the first core contributor to Celestia (17.64%)

Unlocks

Celestia’s 1 billion TIA supply at genesis will be subject to several different unlock schedules. All tokens, locked or unlocked, may be staked, but staking rewards are unlocked upon receipt and will add to the circulating supply.

Circulating supply is defined as the amount of TIA tokens in general circulation without onchain transfer restrictions.

Available supply is defined as the amount of TIA tokens that are either part of the circulating supply or are unlocked but subject to some form of governance to determine when the tokens are allocated. This includes the unlocked portion of the R&D & Ecosystem tokens and the tokens set aside for future initiatives.

Unlock schedule by category is described in the table below.

Note: Due to 2024 being a leap year, the yearly unlock intervals will occur on October 30th of each year. For example, unlocks at year 1 will occur on October 30, 2024.

|

Category |

Unlock Schedule |

|---|---|

|

Public Allocation |

Fully unlocked at launch. |

|

R&D & Ecosystem |

25.00% unlocked at launch. |

|

Initial Core Contributors |

33.33% unlocked at year 1. |

|

Early Backers: Seed |

33.33% unlocked at year 1. |

|

Early Backers: Series A&B |

33.33% unlocked at year 1. |

Where It Gets Exciting: Rollups and Powerful Partners

Just when you thought Celestia’s story couldn’t get more gripping, it unveils its support for rollups—blockchains that process transactions and lean on Celestia for data availability. Optimistic rollups assume transactions are valid unless challenged, while zk rollups use cryptographic proofs for instant verification. Celestia’s Blobstream integration adds a thrilling layer, letting rollups prove data availability with compact proofs like sequence of spans (simpler, location based references) or blob share commitments (more precise but complex).

The real shocker? Celestia’s partnerships with crypto giants like Polygon, Arbitrum Orbit, and Optimism’s OP Stack. In 2023, Polygon added Celestia to its Chain Development Kit, proving its modular design is turning heads. Arbitrum Orbit uses Celestia for data availability, slashing costs compared to Ethereum’s calldata. Optimism’s op batcher now posts rollup data to Celestia, making transactions faster and cheaper. These collaborations are like blockbuster cameos, showing Celestia’s potential to reshape the crypto landscape.

Running Nodes: Join the Celestia Adventure

Want to dive into this thrilling saga? Celestia offers various node types to suit every adventurer. Validator nodes produce and vote on blocks, requiring 24 GB RAM, 8 CPU cores, 3 TiB NVME disk, and 1 Gbps bandwidth for non-archival setups. Consensus nodes sync blockchain history with similar specs. Light nodes, needing just 500 MB RAM, a single CPU core, 100 GB SSD, and 56 Kbps bandwidth, perform DAS to verify data. Bridge nodes connect the DA and consensus networks, while full storage nodes store all data, both requiring 64 GB RAM and 5-6 TiB NVME. Running a node is like joining a secret mission to keep Celestia’s ecosystem thriving.

The Celestia Foundation: The Masterminds Behind the Scenes

Founded by Mustafa Al Bassam (CEO of Celestia Labs), Ismail Khoffi (CTO), and John Adler, Celestia builds on research from 2018-2019. The Celestia Foundation funds development, supports developers, and promotes open source tools. Its Ecosystem Delegation Program keeps the validator set robust, offering delegations to up to 50 validators in cohorts every four months. Validators must run archival bridge nodes, maintain high uptime, and follow a strict code of conduct, ensuring Celestia remains secure and decentralized.

The Foundation’s Modular Meetup Program empowers organizers to host events worldwide, fostering a vibrant community of 167,787 Discord members, 398K Followers Twitter followers, and 16,435 Telegram users.

The Climax: What’s Next for Celestia?

As the curtain rises on Celestia’s future, the possibilities are electrifying. Its modular design enables use cases like scalable DeFi and GameFi rollups, interoperable blockchains, and custom chains tailored to specific needs. Will it outshine Ethereum? While Ethereum’s massive user base gives it an edge, Celestia’s smaller market cap and innovative approach suggest huge growth potential. Backed by venture capital and visionaries like Chris Burniske, Celestia is quietly positioning itself as the data layer for the modular modular future.

Closing Thoughts: A Modular Blockbuster Awaits

Celestia is like a gripping thriller that keeps you guessing. Its modular design, powered by DAS and NMTs, is rewriting the blockchain playbook, making it easier, faster, and cheaper to build scalable networks. Whether you’re a developer launching a rollup, a validator securing the network, or a user staking TIA, Celestia invites you to join its epic journey.

With partnerships like Polygon and Optimism, a buzzing community, and a knack for surprising the crypto world, Celestia is poised to power the next wave of blockchain innovation. So, grab your front row seat and dive into the modular revolution Celestia’s story is just beginning.