Initia’s Breakthrough: A Blockchain Already Shaping the Future

In the ever-evolving world of cryptocurrency, where many projects remain trapped in testnet phases or rely on vague promises of future features, Initia is quietly making a significant impact. Its mainnet is live, its technology is fully operational, and its ecosystem is expanding at a remarkable pace. Unlike other blockchain initiatives that compete for attention with incomplete ideas, Initia has created a system where appchains specialized blockchains designed for specific applications work together seamlessly. By integrating a robust Layer 1 chain, custom rollups, and a developer-friendly tech stack, Initia is building a connected, scalable blockchain economy that’s already delivering results. This article explores how Initia is turning its vision into reality through its active infrastructure, thriving projects, strong partnerships, and engaged community.

The Interwoven Economy: A New Vision for Blockchain

Initia’s core mission is to simplify blockchain development by removing the burden of complex infrastructure decisions from developers. Rather than forcing them to navigate choices about data availability, interoperability, or oracles, Initia provides pre-configured solutions, allowing developers to focus on creating tailored applications for decentralized finance (DeFi), gaming, or non-fungible tokens (NFTs). This approach has given rise to the Interwoven Economy, a system where appchains operate independently but connect effortlessly through a central hub, much like a vibrant city with interconnected neighborhoods. This vision became a reality with the launch of Initia’s mainnet, which leverages Celestia for data availability to ensure efficiency and scalability.

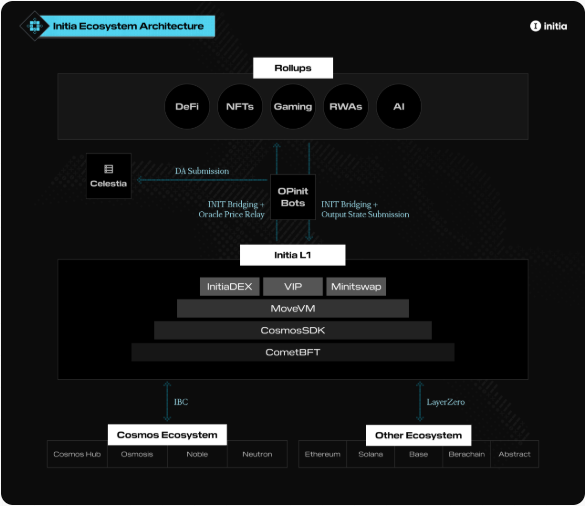

The Interwoven Economy rests on three foundational components: the Initia Layer 1 (L1), which serves as the central hub for liquidity and coordination; Interwoven Rollups, which offer scalable Layer 2 solutions for specialized applications; and the Interwoven Stack, a comprehensive toolkit that streamlines app development. The $INIT token, with a fixed supply of 1 billion, powers this ecosystem, driving incentives through programs like the Vested Interest Program (VIP) and Enshrined Liquidity. These mechanisms align the interests of users, developers, and rollup operators, fostering a dynamic and interconnected network that’s already proving its potential.

Initia L1: The Core of the Ecosystem

Built on the Cosmos SDK, the Initia Layer 1 (L1) is the backbone of the Interwoven Economy, acting as the central hub that coordinates security, governance, and communication across all Interwoven Rollups. It ensures rollups are secure through mechanisms like token bridging, state commitments, and fraud proofs, providing a solid foundation for the ecosystem. At the heart of the L1 is the InitiaDEX, a decentralized exchange modeled after Balancer, which facilitates cross-rollup trading and swaps. The exchange supports weighted pools for diverse assets and StableSwap pools for assets with correlated prices, making it the financial core of the ecosystem.

The L1 excels in interoperability, enabling seamless communication between rollups and external blockchains by routing state transitions through protocols like IBC and LayerZero. This ensures that appchains can interact not only within the Initia ecosystem but also with other chains. The L1 also powers incentive programs, distributing esINIT tokens through the Vested Interest Program and Enshrined Liquidity to reward active participants. By using Celestia for data availability, the L1 focuses on coordination and liquidity, operating as an efficient, high-performance hub that keeps the ecosystem running smoothly.

Interwoven Rollups: Scalable and Tailored Solutions

Interwoven Rollups are Layer 2 blockchains built on top of the Initia L1, offering developers the flexibility to create scalable, secure applications designed for specific use cases. These rollups are like specialized districts in a city, each crafted for a unique purpose, such as gaming or DeFi. Two notable examples already thriving on Initia’s mainnet are Civitia, an onchain landlord game where players mint cities, promoted by Initia’s co-founder on X, and Echelon, a cross-chain lending hub that boosts DeFi yields. Both projects, supported by Celestia’s data availability, demonstrate that Initia’s infrastructure is not just theoretical but actively functional.

Developers building on Interwoven Rollups have significant customization options, allowing them to tailor their applications to meet specific needs. These include:

-

Selecting virtual machines like EVM, Move, or Wasm to match the application’s requirements, ensuring optimal performance.

-

Choosing gas tokens and fee structures, such as INIT, stablecoins, or native tokens, to provide flexibility in transaction costs.

-

Implementing custom transaction ordering mechanisms to prioritize transactions, enhancing the efficiency of the application.

This level of customization, combined with the scalability of rollups, positions Initia as a powerful platform for developers seeking to build innovative applications without constraints on speed or scalability.

MiniEVM: Bridging Ethereum and Cosmos

The MiniEVM rollup framework is a standout feature of Initia, bringing Ethereum Virtual Machine (EVM) compatibility to the ecosystem. This allows developers to deploy Solidity smart contracts using familiar tools like Foundry and Hardhat, making it accessible for those with experience in the Ethereum ecosystem. The MiniEVM integrates with Cosmos through custom precompiles, enabling it to read Cosmos chain states and send transactions. A unified ERC20 interface simplifies token handling for native Cosmos tokens, fee tokens, and assets bridged via IBC, streamlining balance queries and interactions.

However, the MiniEVM uses legacy transaction types instead of EIP-1559, requiring developers to adjust their tools, such as using Foundry’s legacy flag. Its compatibility with IBC ensures seamless bridging with other Cosmos chains, making it a versatile tool for developers looking to combine the strengths of Ethereum and Cosmos ecosystems.

MiniMove and MiniWasm: Diverse Developer Options

For developers seeking alternatives to EVM, Initia offers MiniMove and MiniWasm. MiniMove, based on Aptos’ MoveVM, provides a high-speed, secure environment for building applications, ideal for use cases requiring enhanced performance. MiniWasm, built on CosmWasm, supports CosmWasm contracts, catering to developers familiar with the Cosmos ecosystem. Both frameworks are fully integrated with the Cosmos SDK, ensuring compatibility with Initia’s ecosystem. These diverse options empower developers to choose the best tools for their projects, making Initia a flexible platform for innovation.

The Interwoven Stack: A Developer’s Toolkit

The Interwoven Stack is Initia’s all-in-one solution for building rollups and applications, eliminating the need for developers to assemble components like virtual machines, wallets, or oracles. It provides a comprehensive toolkit that includes bridges, wallets, explorers, and support for multiple virtual machines, ensuring seamless interoperability between rollups, the L1, and external chains. Robust security measures offer a trustworthy foundation for app development, giving developers confidence in their projects.

The Initia Wallet Widget simplifies user onboarding by allowing connections with existing EVM or Cosmos wallets across any rollup, reducing barriers for new users. The Initia Bridge, powered by the Skip Go API, aggregates protocols like IBC, LayerZero, and CCTP for fast, cost-effective token transfers. It even supports swaps through InitiaDEX, enabling use cases like bridging USDC from Ethereum to INIT on the L1. This developer-friendly stack acts like a pre-stocked workshop, freeing creators to focus on building innovative applications.

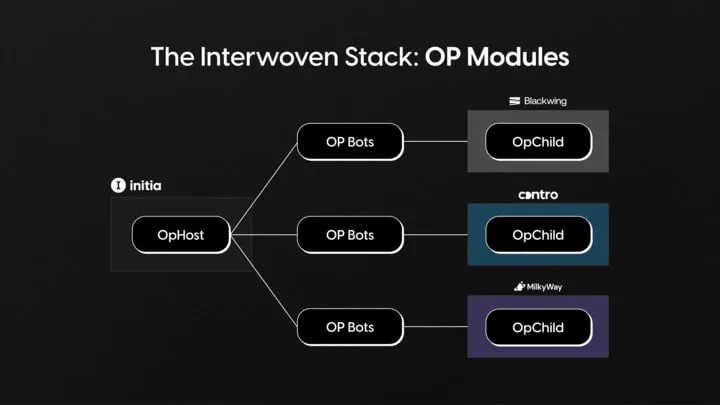

OPinit Bridge: Seamless and Secure Transfers

The OPinit Bridge is a critical component of Initia’s ecosystem, facilitating secure token transfers between the L1 and rollups using an optimistic model. Implemented through OPhost and OPchild Cosmos SDK modules, the bridge relies on an Executor bot to manage deposits, withdrawals, and transaction batch submissions to Celestia. A Challenger bot monitors for invalid proposals, safeguarding rollup integrity. Deposits from L1 to L2 are instant, minting opINIT tokens on the rollup, while L2-to-L1 withdrawals include a challenge period to detect malicious activity.

The Minitswap DEX enhances the user experience by enabling instant L2-to-L1 swaps via IBC, bypassing lengthy withdrawal periods. The Peg Keeper maintains stable swap rates close to 1:1, and Internal Rebalancing replenishes liquidity to protect against manipulation, ensuring capital efficiency. This bridge makes cross-chain interactions smooth and secure, supporting the interconnected nature of Initia’s ecosystem.

Vested Interest Program: Aligning the Ecosystem

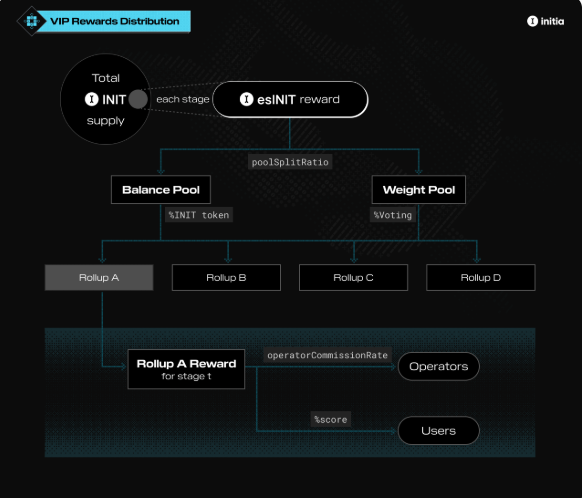

The Vested Interest Program (VIP) is a unique mechanism designed to align the interests of rollup teams, users, and INIT holders. With 250 million INIT (25% of the total supply) allocated, the program distributes esINIT rewards over several years based on ecosystem activity. Rollups must achieve a minimum INIT total value locked (TVL) and pass L1 governance whitelisting to participate. Rewards are divided into a Balance Pool, based on locked INIT volume, and a Weight Pool, allocated through gauge voting similar to Curve Finance.

Rollups set onchain scoring criteria, such as transaction volume or trading activity, to determine user rewards, which are audited during a challenge period to ensure transparency. Users can vest esINIT by maintaining scores or converting to INIT:TOKEN liquidity provider positions on InitiaDEX, gaining voting power in VIP gauges. Operators earn commissions, fostering long-term participation and alignment across the ecosystem.

InitiaDEX and Enshrined Liquidity: Powering Liquidity

InitiaDEX, a Balancer-style decentralized exchange on the L1, serves as the liquidity hub for the ecosystem. It supports weighted pools for diverse assets and StableSwap pools for assets with correlated prices, optimizing trading across rollups. The Enshrined Liquidity model addresses challenges in Proof of Stake systems, such as security-liquidity trade-offs and capital inefficiency. Governance whitelisted INIT:TOKEN liquidity provider positions double as staking assets, allowing users to secure the L1 while earning staking rewards and trading fees from a single position.

With 250 million INIT (25% of supply) allocated for staking rewards and emissions set at 5% annually (adjustable via governance), this model promotes sustainable growth. By combining liquidity provision with staking, Initia ensures users can maximize capital efficiency while contributing to the network’s security and stability.

Binance Launchpool: A Catalyst for Growth

On April 17, 2025, Binance announced Initia as its 68th Launchpool project, offering 30 million INIT (3% of the total supply) for farming from April 18–23, 2025. Users locked BNB, FDUSD, and USDC to earn rewards, with trading starting on April 24, 2025, across pairs like INIT/USDT. Supported by an early pre-seed investment from Binance Labs, this event drove $7.89 million in 24-hour INIT/USDT trading volume (CoinGecko), ensuring strong liquidity. The Launchpool expanded Initia’s community, growing its X following to 209.3K and its Discord community to 316,870 members.

With $INIT priced at $0.4246, a market cap of $67.93 million, and a fully diluted valuation of $423.06 million, Binance’s backing has solidified Initia’s position as a leading Layer 1 chain. The Launchpool attracted new developers and users, boosting activity on rollups like Civitia and Echelon.

Active Projects: Innovation in Action

Initia’s mainnet, powered by Celestia, is a hub of creativity and innovation. Notable projects include:

-

Chains of Chaos: A strategy game announced on X where tokens compete for liquidity, blending memes with trading dynamics to create an engaging experience.

-

Battle for Blockchain: A seven-day financial strategy game that reimagines crypto trading, rewarding players for their strategic skills.

-

Civitia: An onchain landlord game, promoted by Initia’s co-founder, where players mint cities, offering a unique gaming experience.

-

Echelon: A DeFi-focused rollup that provides capital-efficient yields, showcasing Initia’s ability to support advanced financial applications.

These projects highlight Initia’s versatility, making it a platform where diverse, user-focused applications can thrive.

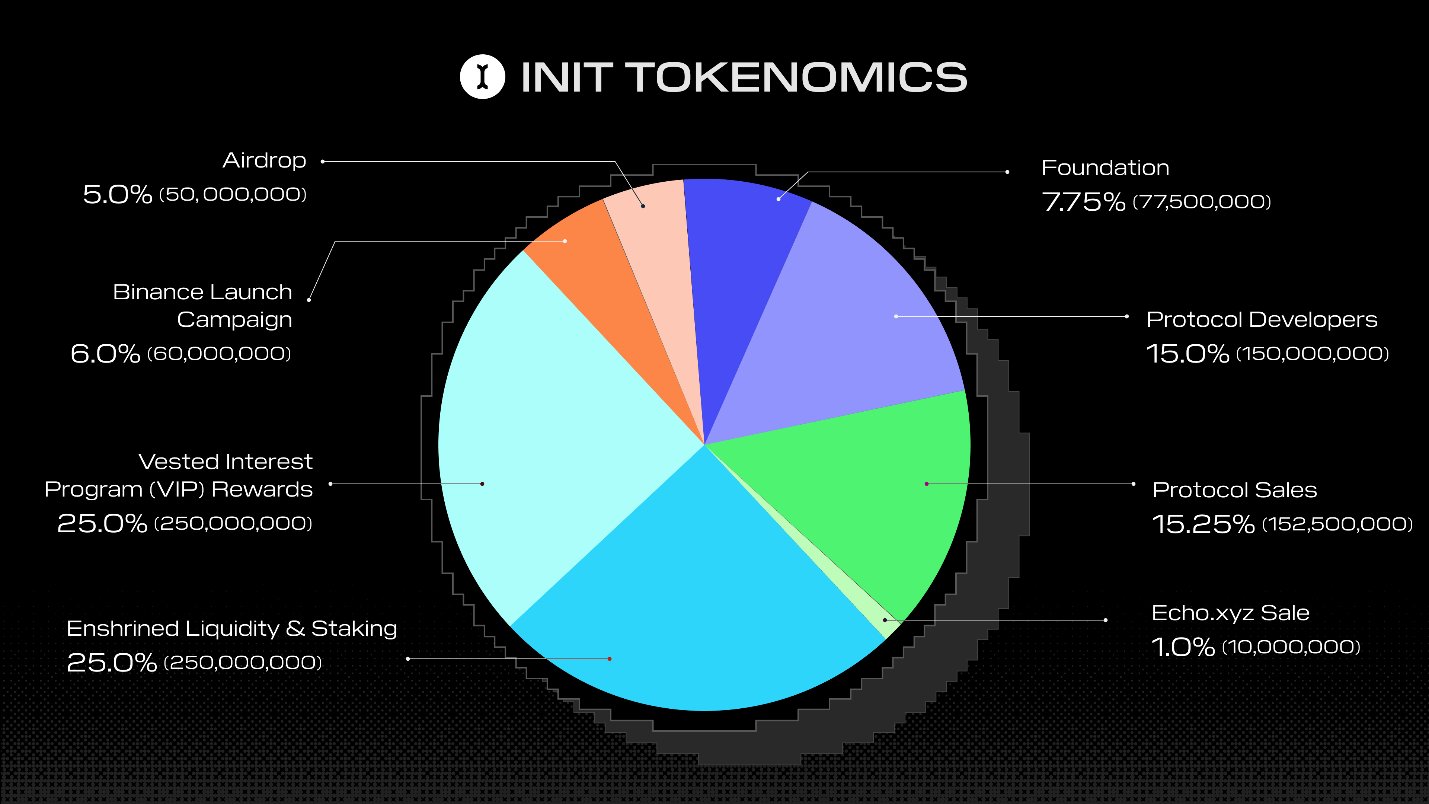

Tokenomics: The $INIT Token

The $INIT token, with a fixed supply of 1 billion, is distributed across eight categories to support ecosystem growth:

-

Enshrined Liquidity & Staking: 250 million (25%), released at 5% annually to support staking and liquidity provision.

-

Vested Interest Program: 250 million (25%), released at 7% annually to reward ecosystem activity.

-

Protocol Developers: 150 million (15%), vesting over four years to support development efforts.

-

Protocol Sales: 152.5 million (15.25%), vesting over four years to fund protocol initiatives.

-

Foundation: 77.5 million (7.75%), with partial upfront vesting to manage ecosystem operations.

-

Binance Launch Campaign: 60 million (6%), unlocked to drive the Launchpool event.

-

Airdrop: 50 million (5%), unlocked to distribute tokens to early users.

-

Echo.xyz Sale: 10 million (1%), vesting over two years to support strategic partnerships.

With 160.57 million tokens in circulation (14.88% of supply), $INIT has seen 30–50% daily gains, peaking at $1.42 and dipping to $0.3388 (CoinGecko), reflecting strong market interest.

What’s Next for Initia

Initia’s Interwoven Economy is setting a new standard for blockchain innovation. With its mainnet live, $INIT gaining traction on exchanges like Binance, MEXC, and Bitget, and rollups like Civitia and Echelon pushing boundaries, Initia is well-positioned to lead the Layer 1 space. Its partnership with Celestia and the Binance Launchpool have amplified its reach, drawing developers, traders, and creators to the ecosystem.

For those looking to engage, the community offers a vibrant space for collaboration, with 316,870 members on Discord, 209.3K followers on X, and 8,405 subscribers on Telegram. Developers can explore the Interwoven Stack at https://docs.initia.xyz to build rollups using MiniEVM, MiniMove, or MiniWasm, leveraging the potential for 100,000 transactions per second. Traders can buy $INIT, currently priced at $0.3879 with a $62.58 million market cap, and stake INIT:TOKEN liquidity provider positions on InitiaDEX for rewards and voting power. Users can bridge tokens via https://bridge.initia.xyz or dive into games like Chains of Chaos or Battle for Blockchain, experiencing the ecosystem’s creativity firsthand.

Initia is not just another blockchain project making promises. It’s a platform that’s already delivering, ready for developers, traders, and creators to shape the future of decentralized applications.