Nischal Shetty’s Share Transfer After WazirX Hack: What It Means for Investors and Legal Proceedings

Explore Nischal Shetty’s share transfer in Shinjuku FZC LLC post-WazirX hack: legal risks, investor recovery, and crypto regulation in India, 2025

Nischal Shetty’s Share Transfer After WazirX Hack: What It Means for Investors and Legal Proceedings

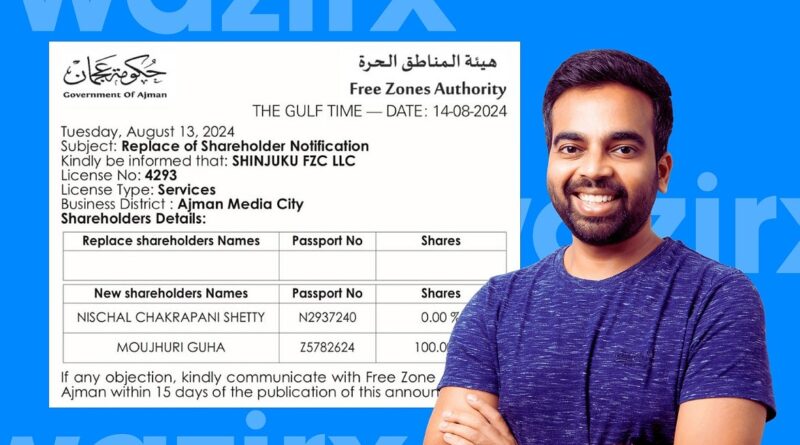

In a surprising development following the massive WazirX hack on July 18, 2024, which saw a staggering ₹2,000 crore ($234 million) loss in user funds, WazirX co-founder Nischal Shetty transferred 100% of his shares in Shinjuku FZC LLC, a WazirX-linked entity, to his wife, Moujhari Guha, on August 13, 2024. This move, widely discussed across social media platforms like X, has sparked curiosity and concern among investors. But what does this share transfer mean in legal terms, particularly for the ongoing WazirX hearings and the recovery of investor funds? Let’s dive into the implications of this high-profile transaction, its potential impact on cryptocurrency regulations, and what it means for WazirX users seeking justice.

Understanding the WazirX Hack and Share Transfer

The WazirX hack, one of the largest crypto exchange breaches in India’s history, left 4.4 million users grappling with frozen funds and uncertainty. As WazirX navigates a Singapore court restructuring to restore 85% of user funds by May 2025, Shetty’s transfer of Shinjuku FZC LLC shares has raised eyebrows. Social media posts on X have labeled the move as potential “asset shielding,” prompting questions about its legality and impact on investor recovery efforts.

Why the Share Transfer Matters

Shinjuku FZC LLC, registered in the UAE, is a key entity linked to WazirX’s operations. Shetty’s decision to transfer his shares to his wife weeks after the hack has fueled speculation about his intentions. Was this a strategic move to protect personal assets, or a routine business decision? The timing and lack of public disclosure have led to accusations of bad faith, with significant implications for WazirX’s ongoing legal battles and investor trust.

Legal Implications of the Share Transfer

- Potential Fraudulent Conveyance Concerns

In legal terms, transferring assets to a close family member after a major financial loss can be viewed as a “fraudulent conveyance” if done to evade creditors. Under India’s Insolvency and Bankruptcy Code, 2016 (IBC), Section 66 allows courts to reverse such transactions if they’re proven to defraud creditors. Similarly, UAE’s Commercial Transactions Law and Singapore’s insolvency laws could permit challenges to the transfer if it’s deemed an attempt to shield assets from WazirX users.

For investors, this means:

- Courts could reverse the share transfer, making Shinjuku FZC LLC’s assets available for creditor recovery.

- The transfer could strengthen claims of mismanagement in ongoing WazirX hearings, potentially leading to penalties for Shetty.

- Impact on WazirX’s Singapore Restructuring

WazirX, through its Singapore-based parent company Zettai Pte. Ltd., is pursuing a Scheme of Arrangement to restructure its operations and repay creditors. The Singapore High Court, with a key hearing set for May 13, 2025, is overseeing this process, which promises to restore 85% of user funds by late May 2025 and the remaining 15% over 2–3 years.

The share transfer could complicate this process by:

- Reducing the pool of recoverable assets if Shinjuku FZC LLC holds significant value.

- Eroding investor confidence, as 93.1% of participating users have already voted in favor of the restructuring plan. Lack of transparency about the transfer could lead to opposition or demands for a forensic audit.

- Prompting creditors to question WazirX’s corporate structure, especially given the ongoing ownership dispute with Binance.

- Regulatory Scrutiny in India

India’s lack of clear cryptocurrency regulations has been a hurdle for WazirX users, as seen in the Supreme Court’s dismissal of a petition against Shetty and others on April 16, 2025. However, the share transfer could attract attention from regulatory bodies like the Enforcement Directorate (ED) or Reserve Bank of India (RBI). The ED’s 2021 allegations of WazirX violating Foreign Exchange Management Act (FEMA) guidelines highlight the potential for further investigations into asset obfuscation.

For investors, this could mean:

- Increased regulatory pressure on WazirX to disclose its corporate dealings.

- Potential for criminal charges under laws like the Prevention of Money Laundering Act, 2002 (PMLA), if the transfer is deemed fraudulent.

- Cross-Jurisdictional Challenges

With Shinjuku FZC LLC based in the UAE, Zettai Pte. Ltd. in Singapore, and WazirX’s operations in India, the share transfer creates a complex legal landscape. Investors may need to pursue claims in UAE courts to challenge the transfer, while Singapore courts oversee the restructuring. In India, the absence of crypto-specific laws limits immediate recourse, pushing users to rely on regulators or international jurisdictions.

What It Means for WazirX Investors

The share transfer has sparked outrage on X, with users accusing Shetty of evading responsibility while launching new ventures like Shardeum. For the 4.4 million affected WazirX users, the transfer could:

- Delay fund recovery if Shinjuku FZC LLC’s assets are critical to the restructuring plan.

- Undermine trust in WazirX’s leadership, potentially jeopardizing the creditor vote for the Singapore restructuring.

- Fuel demands for transparency and accountability, as investors push for audits by firms like Kroll, WazirX’s restructuring advisor.

The Bigger Picture: Crypto Regulation in India

The WazirX hack and Shetty’s share transfer highlight the urgent need for robust crypto regulations in India. As users voice their frustrations on X, the incident could serve as a wake-up call for policymakers to establish clear guidelines, similar to frameworks in the U.S. or EU, to protect investors and ensure accountability in the crypto industry.

What’s Next for WazirX Users?

As the May 13, 2025, Singapore court hearing approaches, WazirX investors should:

- Stay updated on the restructuring plan via WazirX’s official blog.

- Consider filing complaints with the ED or RBI if they suspect foul play in the share transfer.

- Monitor X for real-time updates from the crypto community, using hashtags like #WazirXHack or #CryptoIndia.

While the full impact of Shetty’s share transfer remains unclear, its timing raises valid concerns. Investors deserve transparency, and the coming months will be critical in determining whether this move affects their chances of recovering funds.