Uniswap Outperforms Coinbase in Spot Volume for 2023

Introduction:

In a surprising turn of events, Uniswap, the leading decentralized exchange (DEX), has managed to consistently outpace Coinbase, the prominent U.S. cryptocurrency exchange, in terms of spot trading volume throughout the year 2023.

Rising Volume Figures:

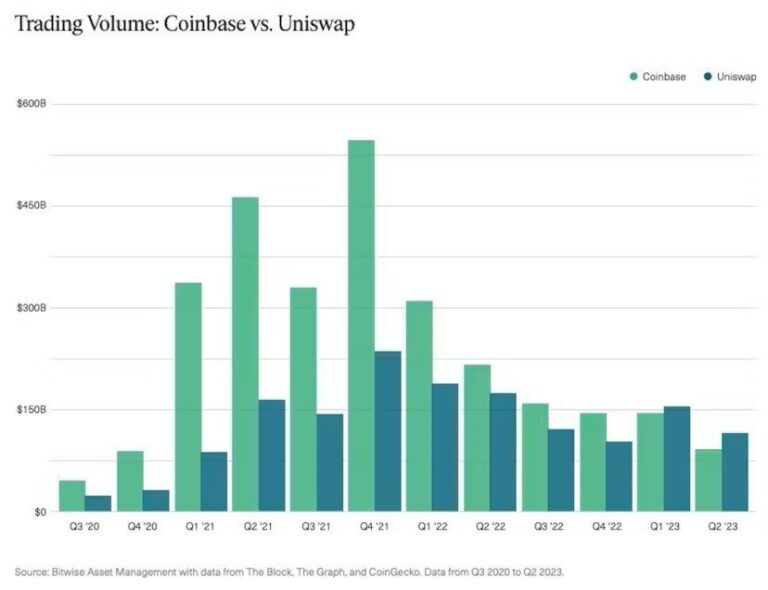

Fresh data disclosed by Bitwise’s crypto asset manager and researcher, Ryan Rasmussen, highlights Uniswap’s remarkable achievement. According to Rasmussen’s findings, Uniswap achieved an impressive trading volume of approximately $110 billion during the second quarter, surpassing Coinbase’s $90 billion in volume for the same period.

Uniswap’s triumph over Coinbase was most pronounced during the first quarter of the year when the DEX processed around $155 billion in trades compared to Coinbase’s $145 billion. This marked the first instance of Uniswap overtaking Coinbase in quarterly spot trading volume.

Market Trends and Bear Market Resilience:

Notably, Coinbase faced a more substantial decline in spot trading activity amidst the bear market, experiencing an 83% reduction from its Q4 2021 volume of roughly $540 billion. Uniswap, while still impacted, saw a less severe drop of 50% from its $235 billion volume over the same period.

These figures underscore the resilience demonstrated by significant decentralized protocols amid the prolonged downturn in the crypto market. The harsh realities of the 2022 bear market inflicted significant damage upon centralized crypto entities, including exchanges, lenders, and venture capital firms, further bolstering the case for decentralized protocols that operate autonomously based on pre-defined code.

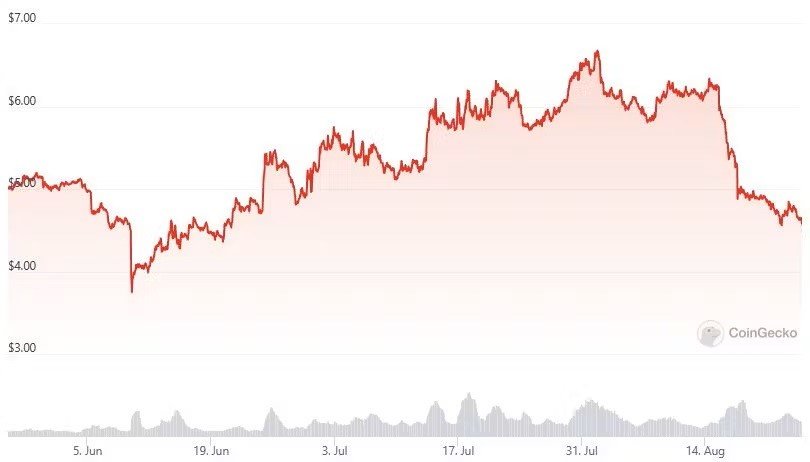

Despite Uniswap’s increased trading volume in 2023, its native token UNI has experienced a 10% decline this year, remaining significantly below its all-time high in May 2021 by a margin of 90%.

Expansion Initiatives and New Offerings:

Uniswap’s triumph in trading volume coincides with its efforts to expand its market influence through innovative products. The DEX recently unveiled its upcoming iteration, labeled v4. This upgraded protocol introduces features such as limit orders, automated fee revenue compounding for liquidity providers, and adaptable plugins. Moreover, v4 pools on Uniswap can function as time-weighted average market makers (TWAMM), enabling gradual execution of larger orders.

Uniswap Labs intends to launch v4 post the Ethereum network’s next significant upgrade, known as Dencun.

Additionally, Uniswap introduced UniswapX, a decentralized exchange aggregation protocol, last month. This protocol allows third-party entities serving as market makers to vie for order flow by offering the most favorable prices to traders. UniswapX also incorporates measures to counter Maximal Extractable Value. The protocol is currently in beta and accessible to opt-in users.

Conclusion:

The story of Uniswap’s remarkable rise in trading volume vis-à-vis Coinbase underscores the evolving landscape of decentralized exchanges and their ability to withstand market fluctuations. While facing challenges, Uniswap’s endeavors to innovate and diversify its offerings signal a forward-looking strategy in the dynamic cryptocurrency ecosystem.

We invite you to share your thoughts on Uniswap’s ascent and the broader implications it holds for the industry in the comments section below.