WazirX Scam: Illegality of Token Reallocation & Investor Remedies

In July 2024, WazirX, India’s leading cryptocurrency exchange, suffered a devastating $230 million hack, losing Ethereum and ERC-20 tokens stored in a multisig wallet. While non-ERC-20 tokens, such as Bitcoin, TRX, and USDT, remained untouched by the hack, WazirX’s management implemented a controversial “socialized loss” strategy, freezing all user assets, including unhacked tokens, to offset losses. This was done without explicit user consent, triggering widespread outrage. An affidavit filed by Romy Johnson in a Singapore court recently exposed critical issues, alleging violations of trust law and user rights. But the key questions are:

Is WazirX’s rebalancing illegal under Indian law?

Does it constitute a criminal act by withholding unhacked tokens?

And what robust remedies do Indian investors have to reclaim their non-ERC-20 tokens?

Let’s dive in !!

I. THE INVESTOR-EXCHANGE RELATIONSHIP: A CUSTODIAL TRUST

To understand the core issue with WazirX, we must first examine the legal nature of the relationship between an investor and a crypto exchange.

When you deposit tokens on WazirX, you remain the legal owner of those assets. WazirX—operated jointly by Zanmai Labs Pvt. Ltd. (India) and Zettai Pte. Ltd. (Singapore)—acts merely as a custodian, holding your tokens in trust. This custodial role imposes fiduciary obligations under Indian law, including the duty to safeguard your assets and return them on demand.

Even WazirX’s own user agreement and public statements emphasize that deposited tokens remain the property of the user. Ownership is not transferred to the exchange.

Therefore, when WazirX froze unhacked non-ERC-20 tokens and reallocated them to compensate losses arising from a hack involving ERC-20 tokens, it exceeded its authority as a custodian. This move directly violated:

- Your legal right to property,

- The principles of fiduciary duty under Indian trust law, and

- WazirX’s own contractual representations.

II. WHY WAZIRX’S “SOCIALIZED LOSS” STRATEGY IS LEGALLY FLAWED

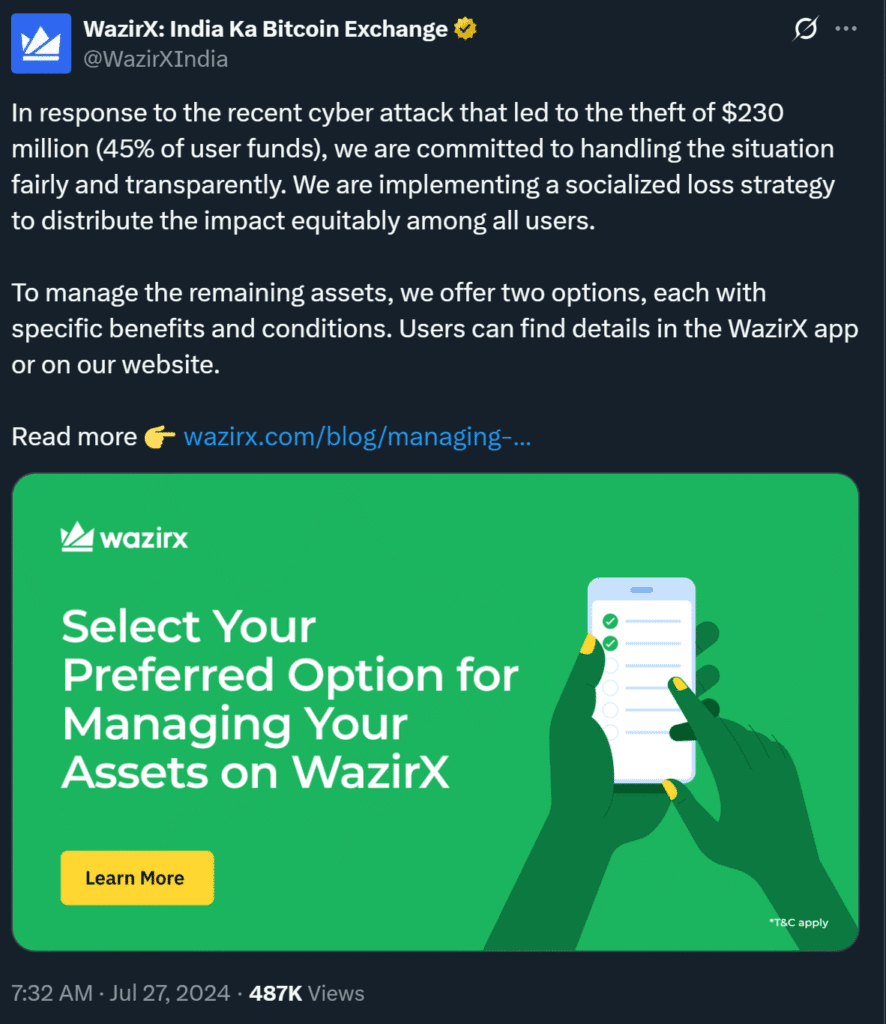

On July 27, 2024, WazirX announced a controversial “socialized loss” strategy. Under this scheme, 45% of all user assets (including unhacked non-ERC-20 tokens) were converted into USDT-equivalent tokens and locked, leaving only 55% of each user’s portfolio available for withdrawal or trading.

This reallocation was presented as a “rebalancing” exercise to stabilize the platform post-hack. But legally, it raises serious red flags, for several reasons:

A. Violation of Ownership and Trust Principles

WazirX, acting as a custodian, is bound by the Indian Trusts Act, 1882, which prohibits a trustee from using trust property for unauthorized purposes.

By using unhacked user tokens to offset losses of others—without individual consent—the exchange breached the core principle of trust law. This is further supported by Romy Johnson’s affidavit, which rightly demands segregation between:

- Category A assets (unhacked tokens)

- Category B assets (compromised ERC-20 tokens)

B. Lack of Informed and Genuine Consent

WazirX claimed that 93% of users approved this strategy via a poll. However, as alleged in Johnson’s affidavit, this approval was misleading:

- Unhacked token holders were bundled into the same vote, regardless of whether they suffered losses.

- Many users either rejected or did not participate in the vote, as evident from social media posts and screenshots circulating on Twitter.

This manufactured consensus finds parallels in the Singapore cases of Re UDL [2002] and Re Punj Lloyd [2019], where bundling creditors with differing interests into a single group vote was held improper. Thus, WazirX’s reliance on this poll does not satisfy the legal requirement of informed and voluntary consent.

C. Unjust Enrichment at Users’ Expense

This strategy also amounts to unjust enrichment. WazirX essentially used unaffected user assets to bail itself out and avoid insolvency, without compensating those users.

Under Indian law, unjust enrichment occurs when one party gains at the expense of another without legal justification. In this case, WazirX’s benefit came at the direct cost of those whose assets were unhacked and should have remained untouched.

Importantly, non-ERC-20 tokens are not liabilities of the exchange—they are user-owned assets, and thus cannot be pooled into a restructuring effort, as clarified in the Singapore case of Re IM Skaugen [2018].

D. Misrepresentation and Unlicensed Operations

Finally, Zettai Pte. Ltd., the Singapore-based operating entity of WazirX, did not hold a license under the Singapore Payment Services Act, despite marketing itself as a regulated and trustworthy custodian.

This raises two critical issues:

- Misrepresentation to investors and users about the regulatory status of the exchange;

- Further violation of Indian consumer and financial laws, since unlicensed and unregulated custodial services were offered to Indian users without adequate disclosure or legal safeguards.

III. CRIMINAL ACTS BY WAZIRX AND ITS DIRECTORS

The conduct of WazirX and its leadership, as detailed in user complaints and the affidavit submitted by Romy Johnson, reveals a prima facie case of multiple criminal offences under Indian law. These actions are prosecutable under the Bharatiya Nyaya Sanhita, 2023 (BNS)—which replaced the Indian Penal Code in July 2023—as well as other relevant legislation.

The allegations of financial opacity, dishonest misrepresentation, asset misappropriation, and possible internal misconduct support a strong case for criminal investigation.

A. Cheating (Section 316, BNS)

Section 316 defines cheating as dishonestly inducing someone to deliver property or consent to its retention, thereby causing harm.

WazirX induced users to keep their unhacked tokens on the exchange by misrepresenting the platform’s security and custodial integrity. Subsequently, the freezing of 45% of non-ERC-20 tokens and their unauthorized reallocation to cover hacked ERC-20 losses directly caused financial harm to innocent users.

The affidavit further alleges that the user vote was manipulated, suggesting intentional deception—a key element under this offence.

B. Criminal Breach of Trust (Section 314, BNS)

Under Section 314, a person entrusted with property who dishonestly misappropriates or disposes of it in violation of legal or contractual obligations commits criminal breach of trust.

As a custodial exchange, WazirX was entrusted with users’ non-ERC-20 tokens.

By reallocating those tokens without user consent, the exchange breached its fiduciary duty and trust obligations.

The affidavit also points to deeper irregularities:

- ₹920 crore in revenue,

- No employees at Zanmai Labs,

- Alleged fund transfers to shell entities.

These facts may establish dishonest intent and misappropriation on the part of directors and key decision-makers.

C. Fraudulent Deeds (Section 318, BNS)

If it is proven that WazirX intentionally misrepresented asset security, manipulated voting outcomes, or made false claims about recovery mechanisms, it would fall squarely under Section 318 (Fraud).

The affidavit’s demand for a forensic audit could reveal whether the exchange’s leadership knowingly misled users about:

- The status of their assets,

- The legality of reallocation, and

- The decision-making process behind the vote.

Such findings would strengthen charges of fraud and deception.

D. Cheating by Personation Using Computer Resources (Section 66D, IT Act, 2000)

If WazirX’s failure to secure multisig wallets or internal access controls was due to gross negligence or internal sabotage, it may amount to cheating by personation under Section 66D of the Information Technology Act, 2000.

This provision targets situations where someone deceives users through digital means—including manipulation or misuse of system access—to obtain property or cause harm.

Blockchain analyses and leaked admin records could serve as key evidence here.

E. Money Laundering (Prevention of Money Laundering Act, 2002)

If funds from hacked wallets or user deposits were routed through shell entities, as the affidavit suggests, this could trigger serious violations under the PMLA.

Under this law, any attempt to:

- Conceal,

- Possess,

- Use, or

- Transfer proceeds of crime (including misappropriated crypto assets)

may be deemed as money laundering.

Whether the hacked funds were diverted to or by Zettai Pte. Ltd. or other offshore accounts will be crucial. A forensic audit could uncover whether the directors or senior executives were complicit in laundering user funds.

IV. INDIAN AUTHORITIES ENTITLED TO ACT

A crucial legal question arises: Can Indian authorities take action against WazirX and its operations, despite Zettai Pte. Ltd. being incorporated in Singapore and currently undergoing restructuring under Singapore’s Insolvency, Restructuring and Dissolution Act (IRDA)?

The answer is yes. Indian regulators and law enforcement agencies retain jurisdiction and are well within their legal authority to investigate and initiate proceedings against Zanmai Labs Pvt. Ltd., the Indian entity operating WazirX, especially for acts that may constitute criminal offences or violations of Indian consumer and financial laws. Here’s how:

A. Economic Offences Wing (EOW)

The Economic Offences Wing is empowered to investigate various offences under the Bharatiya Nyaya Sanhita (BNS), including:

- Cheating (Section 316)

- Criminal breach of trust (Section 314)

- Fraud (Section 318)

Several users have already filed complaints against Zanmai Labs, prompting EOW inquiries in multiple jurisdictions. While Singapore’s IRDA moratorium may temporarily delay direct cross-border actions, it does not restrict domestic Indian investigations into criminal conduct by the Indian entity or its officers.

B. Enforcement Directorate (ED)

The Enforcement Directorate can initiate action under the Prevention of Money Laundering Act (PMLA) if there is evidence that funds were diverted or layered through shell entities — a key allegation in the affidavit claiming that WazirX generated ₹920 crore in revenue and potentially routed substantial amounts through Zettai and other unregulated intermediaries.

If these transactions involve proceeds of crime, the ED is empowered to attach properties, freeze accounts, and arrest individuals associated with the laundering chain.

C. RBI and SEBI

While India has not yet enacted a comprehensive legal framework for cryptocurrencies (as of July 2025), both the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) can still exercise oversight in the following contexts:

- RBI may scrutinize potential violations of FEMA, unauthorized cross-border transactions, or activities that threaten monetary stability.

- SEBI may act if WazirX or Zettai misrepresented token listings, investment returns, or launched schemes resembling collective investment schemes (CIS) without requisite registrations.

Given that Zettai Pte. Ltd. was not licensed in either India or Singapore for custodial services, and the platform handled millions in Indian user funds, both agencies may take suo motu cognizance of regulatory breaches.

V. LEGAL REMEDIES FOR INDIAN INVESTORS: RECLAIMING UNHACKED TOKENS

Indian investors holding unhacked non-ERC-20 tokens have robust legal and practical remedies to reclaim their assets, despite jurisdictional challenges. Here’s a detailed guide to empower you:

A. File an FIR with EOW:

-

- Lodge a First Information Report with your local police or EOW, alleging cheating (S.316, BNS), criminal breach of trust (S.314, BNS), and fraud (S.318, BNS). Provide:

- WazirX account statements showing non-ERC-20 token holdings.

- WazirX’s hack and rebalancing announcements (July 18–27, 2024).

- Romy Johnson’s affidavit alleging vote manipulation and financial opacity.

- User posts on X highlighting restricted access (e.g., 45% locked in USDT).

- Outcome: An FIR can initiate a criminal investigation into Zanmai Labs, potentially leading to prosecution or asset release. It also pressures WazirX to negotiate. File at your local police station or EOW branch (e.g., Mumbai EOW for Zanmai Labs’ base).

- Lodge a First Information Report with your local police or EOW, alleging cheating (S.316, BNS), criminal breach of trust (S.314, BNS), and fraud (S.318, BNS). Provide:

B. Civil Suit for Recovery:

-

- File a suit in a district court under the Specific Relief Act, 1963, asserting ownership of your non-ERC-20 tokens and demanding their return. Cite:

- Indian Trusts Act, 1882, for WazirX’s fiduciary breach.

- Argument that unhacked tokens are not corporate liabilities.

- Seek an injunction to freeze WazirX’s Indian operations or compel token release.

- Outcome: A court order could restore your tokens, but cross-border enforcement against Zettai is complex.

- File a suit in a district court under the Specific Relief Act, 1963, asserting ownership of your non-ERC-20 tokens and demanding their return. Cite:

C. Regulatory Complaints:

- File complaints with the RBI or SEBI, alleging unregistered operations and misrepresentation. Highlight Zettai’s unlicensed status and the affidavit’s financial opacity claims.

- Outcome: Regulatory scrutiny may push WazirX to negotiate or expedite token release, though crypto’s unregulated status limits impact.

- Tip: Submit complaints via RBI’s CMS portal or SEBI’s SCORES platform.

D. Practical Steps to Maximize Recovery:

- Demand Transparency: Email WazirX, citing your ownership of non-ERC-20 tokens, custodian and no consent arguments, and Indian trust law. Demand immediate release, referencing the fiduciary breach as per law.

- Monitor Developments: Track the Singapore case via news or user communities on X for updates on token release.

- Engage Legal Counsel: Hire a lawyer specializing in consumer or cyber law to file complaints and coordinate with Singapore advocates.

- Outcome: These steps increase pressure on WazirX, improve recovery chances, and protect your assets long-term.

VI. CHALLENGES AND CRITICAL CONSIDERATIONS

Pursuing remedies faces hurdles:

- Jurisdictional Conflict: Singapore’s IRDA moratorium may delay Indian court orders until the July 15, 2025, hearing.

- Unregulated Crypto: India’s lack of crypto-specific laws as of July 2025 forces reliance on general BNS and trust law, creating ambiguity.

- Evidence Burden: Proving criminal intent requires financial records, which the affidavit’s forensic audit may provide.

- WazirX’s Defenses: WazirX may cite its User Agreement or Singapore’s court approval, though the vote manipulation claims weaken these.

However, the evidences, vote manipulation, ₹920 crore revenue with “zero employees,” and potential multisig misuse – bolsters the case for criminality.

Indian authorities can target Zanmai Labs, and a Singapore ruling could set a global precedent.

Conclusion

WazirX’s socialized loss strategy, freezing unhacked non-ERC-20 tokens without consent, is illegal under Indian trust law and constitutes cheating (S.316, BNS), criminal breach of trust (S.314, BNS), and potentially fraud (S.318, BNS). By breaching fiduciary duties, WazirX and its directors have wronged investors, as exposed by Romy Johnson’s affidavit. Indian investors can reclaim their tokens by filing FIRs with the EOW, civil suits, and engaging regulators.

Practical steps like emailing WazirX and networking with user communities amplify your efforts. The July 15, 2025, Singapore hearing could unlock your assets, but immediate action in India is key. Fight for your rights—file complaints, demand transparency, and join the movement for crypto justice!

Disclaimer : This article is for informational/educational purposes only, and does not constitute legal advice. The content reflects the author’s personal interpretation of publicly available facts, laws, and allegations related to WazirX and its operations. Readers are advised to consult a qualified legal professional for advice specific to their situation. The author and publisher disclaim any liability arising from reliance on the information provided herein.