Fantom Sharp Drop in TVL

Fantom Token Faces Sharp TVL Drop Following Multichain Hack - Evaluating the Significance and Future Prospects

In a startling turn of events, Fantom Token, a once-promising cryptocurrency project, has witnessed a steep decline in its Total Value Locked (TVL) after falling victim to a multichain hack. This incident has ignited a debate about the crucial role TVL plays in the crypto space, raising questions about the implications of both high and low TVL for projects like Fantom.

Fantom Token's Historical TVL High and Recent Plunge:

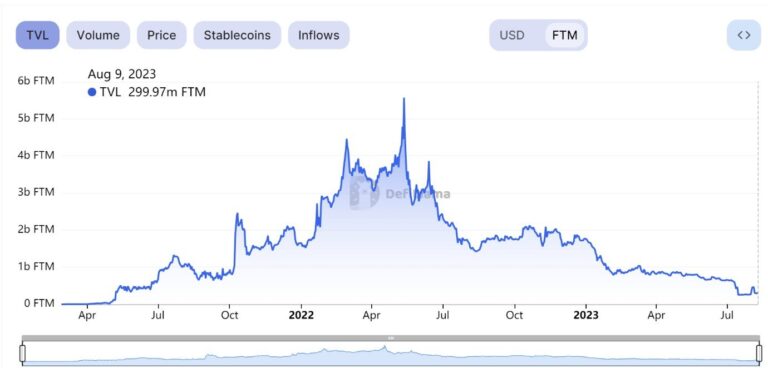

It’s essential to reflect upon Fantom Token’s journey, particularly its significant TVL fluctuations. At its pinnacle, Fantom Token achieved a remarkable all-time high TVL of approximately $7.58 billion dollars, demonstrating the project’s immense potential and investor confidence. However, the recent multichain hack and subsequent events have led to a startling nosedive in TVL, plummeting to a mere $71 million dollars. The stark contrast between these figures underscores the volatility and challenges that crypto projects like Fantom can face.

Over the past five months, Fantom Token’s TVL has experienced a staggering decline of more than 85%. A mere half-year ago, the project’s TVL stood at a commendable $500 million dollars, showcasing a promising growth trajectory. However, the recent series of unfortunate events has led to a rapid erosion of value and confidence, leaving stakeholders and observers alike contemplating the project’s future direction.

This steep decline in TVL serves as a cautionary tale, highlighting the inherent risks and uncertainties within the cryptocurrency landscape. Fantom Token’s sharp decline reminds us that even projects with significant potential can face unforeseen challenges that impact their TVL, investor sentiment, and overall trajectory. As Fantom Token navigates this critical juncture, its ability to recover and rebuild its TVL will be a pivotal factor in determining its long-term success and viability.

Understanding Total Value Locked (TVL):

Total Value Locked refers to the total amount of assets (typically in cryptocurrencies) that are currently staked or locked in a decentralized finance (DeFi) protocol or platform. It serves as a key indicator of the health and adoption of a crypto project. High TVL is often interpreted as a sign of investor confidence, strong community engagement, and the platform’s ability to generate returns for its users. Conversely, low TVL may suggest waning interest, potential vulnerabilities, or a lack of utility within the ecosystem.

The Significance of High TVL:

Projects boasting high TVL are often seen as robust and reliable. This implies that users trust the protocol enough to lock up significant amounts of their assets, as they expect attractive yields or returns. High TVL also bolsters the protocol’s liquidity and lending capabilities, enabling it to offer better rates and a wider range of financial products. Consequently, this can attract more users and investors, creating a positive feedback loop of growth.

The Perils of Low TVL:

Low TVL can be a red flag, indicating that a crypto project is struggling to attract users or retain its existing user base. This might be due to various factors such as perceived risks, lack of utility, or competition from other platforms. A low TVL can lead to liquidity issues, making it difficult for the platform to fulfill its promises and obligations. Additionally, low TVL might make the protocol vulnerable to attacks, as it could lack the resources to defend against malicious actors.

Fantom Token's Dilemma:

The recent multichain hack targeting Fantom Token has resulted in a dramatic drop in its TVL. This incident not only exposes vulnerabilities within the platform but also highlights the fragility of the entire DeFi ecosystem. Investors and users are now questioning the project’s security measures and its ability to recover from such setbacks.

Fantom Token’s future prospects hang in the balance. The project must prioritize security enhancements, transparency, and community engagement to restore trust and encourage users to return. Rebuilding its TVL will be crucial, as a robust TVL can attract institutional investors, developers, and users, thereby revitalizing the project’s growth trajectory.

The Road Ahead for Fantom:

To regain its footing, Fantom Token must:

- Strengthen Security: Implement rigorous security audits and improvements to prevent future breaches and hacks.

- Enhance Transparency: Communicate openly about the hack, its impact, and the steps being taken to address the situation.

- Incentivize Participation: Introduce attractive rewards, yields, and benefits to incentivize users to return and lock up their assets.

- Diversify Use Cases: Expand the ecosystem’s utility by introducing new and innovative use cases, appealing to a wider audience.

Community Building: Foster a strong and engaged community through educational initiatives, partnerships, and outreach efforts.

In conclusion, the recent sharp drop in Fantom Token’s TVL has underscored the critical role it plays in the success of a crypto project. While a high TVL signifies confidence and growth potential, a low TVL raises concerns about viability and security. The future of Fantom Token hinges on its ability to recover from the multichain hack, restore user trust, and rebuild its TVL through a combination of security enhancements, transparency, and community engagement.